Have you been injured in a car accident? FVF Law’s top rated Austin car accident lawyers have helped countless people in making educated choices about their car accident cases. We can help determine whether hiring our injury lawyers is the best choice for you. Contact us to get a free consultation at (512) 982-9328.

Understanding your options following a car accident in Austin is the best way to make sure you are not taken advantage of by an insurance company, and to prepare yourself to make informed decisions that will ensure the best outcome for your case.

There are many car accident lawyers in Austin, Texas, but very few are as committed to their clients’ well being and financial security as we are at FVF Law.

With hundreds of accident cases under our belts, we can help you resolve your Austin car accident injury claim and maximize the outcome of your situation.

More specifically, here are a few of the benefits we bring:

If you have been involved in a car crash in Austin, Texas, you should at least understand your options before you make any concrete decisions about your case. That’s why we recommend you contact us for a free case consultation with our experienced top rated Austin car accident lawyers.

We will lay out the various routes you can take and explain how you can obtain the resources you need to move past this difficult chapter of your life.

Hiring an Austin car accident lawyer — or at least arranging a free consultation with one — can help your insurance claim and/or legal case in many ways. Proper handling of a car accident case requires the development of a strategy, and that should begin as soon as possible after the crash. Here are just a few of the ways we can help:

At FVF Law, we understand the challenges you face after an injury. That’s why we offer no-obligation consultations to discuss your case and explore your options. Whether you choose us as your legal representatives or not, our priority is helping you get better. We’ll provide guidance and support to ensure you understand your rights and the best path forward. Contact us today to schedule your consultation and let us help you find the right options for your situation.

In most car accident cases, Texas gives you two years from the date of the crash to file a personal injury lawsuit. This is known as the statute of limitations. If you try to file after this deadline, your case will likely be dismissed, even if you have strong evidence.

There are a few important exceptions:

Even though two years might seem like plenty of time, waiting can hurt your case. Evidence disappears, witnesses forget details, and insurance companies may use delays against you. That’s why it’s critical to speak with an attorney as soon as possible after your crash.

Taking the right steps immediately after a crash can make or break your case. From gathering evidence to dealing with insurance adjusters, knowing what to do (and what not to say) is critical.

Here are key steps to protect your rights after a crash in Austin:

Contact the top rated Austin car accident lawyers from FVF Law to understand your rights and what to expect.

Acting quickly helps preserve your claim and keeps you in control of the process. Waiting or handling things on your own often gives the insurance company the upper hand.

Contact FVF Law in Austin today for a free, no-pressure consultation. Our team will help you understand your rights, your timeline, and your best path forward.

Austin, Texas, faces significant challenges regarding road safety, reflecting broader trends across the state and nation.

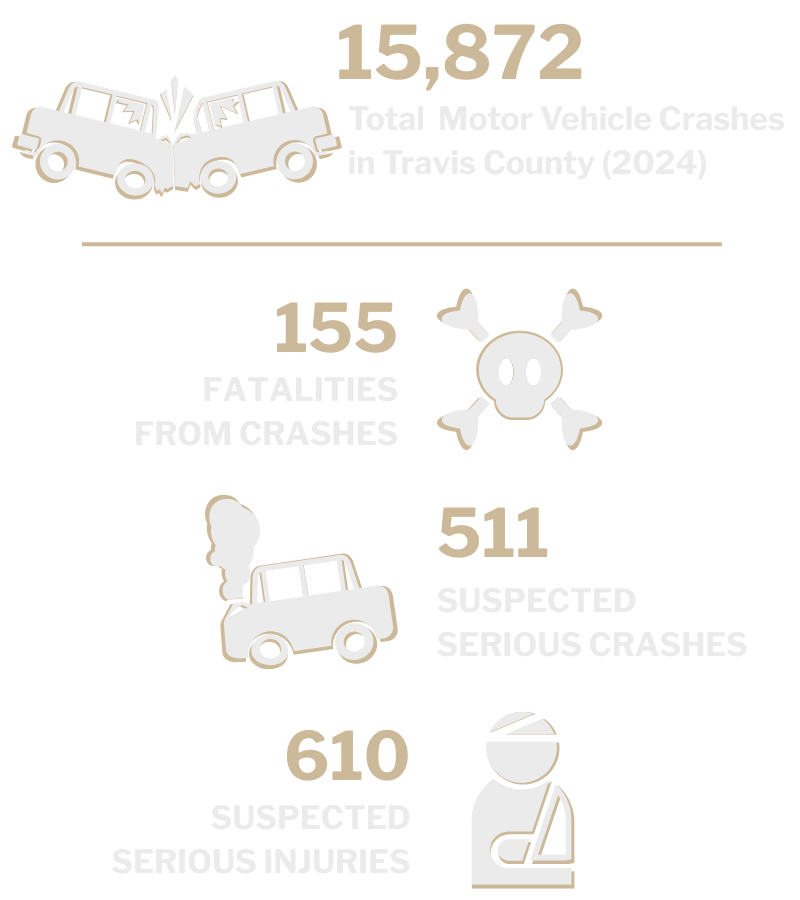

According to the Texas Department of Transportation (TxDOT), Travis County, where Austin is located, recorded a total of 15,872 motor vehicle crashes in 2024. These incidents led to 155 fatalities, 511 suspected serious crashes, and 610 suspected serious injuries.

The county also reported 3,391 suspected minor crashes, 2,941 possible injury crashes, and 8,423 non-injury crashes.

While not all of these crashes occurred within Austin city limits, Austin accounts for the vast majority of Travis County’s population and roadway traffic, making these figures a strong indicator of local road safety trends.

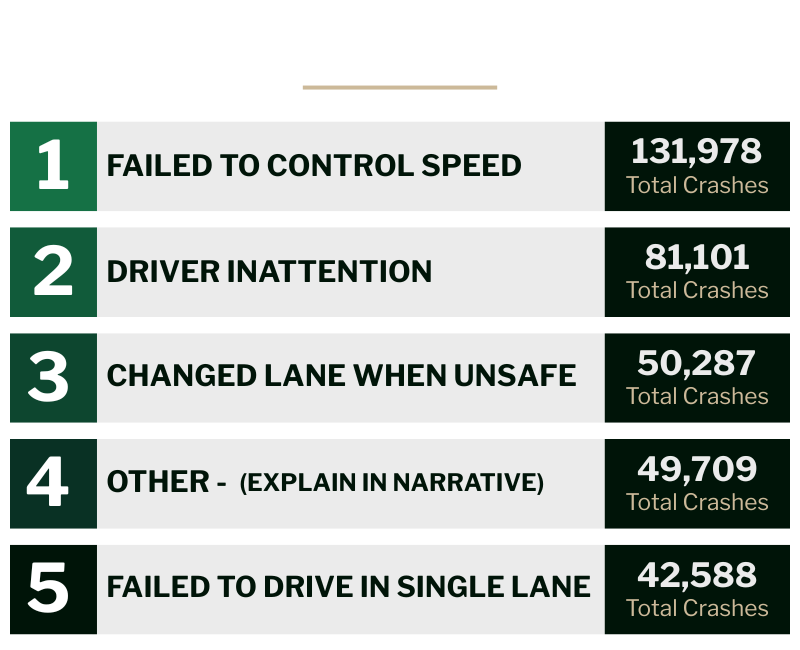

Delving deeper into the statistics, here is the full list of contributing factors to car crashes in Texas during 2024:

Here are some key insights from the Texas Motor Vehicle Traffic Crash Facts report for 2024:

Texas experienced a decrease in the number of motor vehicle traffic fatalities. The 2024 death toll of 4,150 was a decrease of 3.29% from the 4,291 deaths recorded in 2023.

Based on reportable crashes in 2024, 1 person was killed every 2 hour and 7 minutes, 1 person was injured every 2 minutes and 5 seconds, and 1 reportable crash occurred every 57 seconds.

The Fatality Rate on Texas roadways for 2024 was 1.35 deaths per 100,000,000 vehicle miles traveled. This is a 5.25%

decrease from 2023.

There are many factors that can cause accidents, which is exactly why complicated cases might need an expert to investigate and prove liability. The following are some of the most common causes:

Collisions can happen in various ways. The speed of the vehicles, point of impact, and other factors will all play a role in a car accident claim. You should hire an attorney who has handled all types of collision cases so that they’ll be equipped to prove causation, liability, and damages.

The top rated auto accident attorneys at FVF Law have helped victims who have sustained injuries in all types of crashes, including:

Our attorneys are here to provide sound legal advice and guide you through the claims process.

Contact us today to discuss your collision and learn more about your legal options.

While some car accidents are little more than “fender benders” and cause little or no bodily injury, others are serious or even catastrophic, resulting in often irreparable physical harm. Common types of car accident injuries include:

In addition to physical injuries, many crash victims suffer emotional trauma, mental distress, and other neurological symptoms. This can manifest as the following:

Even if you think your injuries aren’t serious enough to warrant medical attention or believe that you may recover at home without treatment, it’s important to see an Austin medical professional as soon as possible for two reasons:

If symptoms do not get better, or actually worsen later, the insurance company will argue that your injury is not related to the car accident if you did not do a good job of treating your injuries early and consistently.

After a car accident in Austin, three potential types of compensation are available: economic, non-economic, and punitive.

Economic damages make up for your financial losses, including:

Non-economic damages compensate you for the other types of consequences you have experienced, such as:

Punitive damages are only awarded in rare personal injury cases that involve extreme conduct from the at-fault party, such as when they act with malicious intent as opposed to mere negligence. These damages are meant to “punish” the defendant for their behavior.

Every car accident claim is unique, with different victims, injuries, and circumstances.

Accordingly, the value of your case will depend on several factors:

Other things can affect how much your Austin car accident case is worth. The best way to determine the value of your claim is by speaking with an experienced Austin car accident attorney from FVF Law.

In Texas, you can still recover the compensation you deserve after a car crash even if it was partly your fault. However, this is only true up to a certain point. The state currently has a modified comparative negligence standard with a 51% bar to recovery.

Under this standard, you will be assigned a percentage of fault for your car accident. If this percentage is 51% or more, you cannot recover compensation. Otherwise, your compensation may be reduced according to your assigned percentage.

For example, your damages award could be reduced by 20% if you are assigned 20% of the blame.

You can be certain that the opposing party will try to blame you for your crash, as successfully doing so could reduce or eliminate their liability for your injuries. But with an experienced Austin car accident attorney on your side, you’ll be able to respond effectively to allegations of fault.

Most auto accident lawyers operate under a contingency fee agreement, meaning you owe nothing upfront. You’ll only owe attorney’s fees if your legal team secures a favorable settlement or verdict on your behalf.

The attorney’s fees are typically between 33 – 40% of your awarded compensation. The percentage will depend on several factors, such as the complexity of your case, the work required to prove it, and whether it goes to trial.

During your free initial consultation, we’ll discuss our contingency fee arrangement with you and answer any questions you may have.

Were you injured in a car accident in Austin, TX? If so, FVF Law Firm – Injury & Wrongful Death Lawyers is here to advocate for you. We’ve been helping personal injury victims recover fair compensation since we opened our doors in 2014.

We’re prepared to put our 100 years of combined experience to work for you to ensure that you’re treated fairly and receive the compensation you deserve after a collision.

Call our top rated Austin car accident attorneys to learn more about our legal services and how we can help you. We offer a free, no-obligation consultation, so schedule yours today.

Your actions after a collision may affect the outcome of your case, so it’s important that you take some steps to protect yourself to keep your legal options open.

In Texas, the statute of limitations for personal injury claims is two years.

The clock starts running from the date of the accident. Exceptions to this deadline can sometimes be made, so check with an Austin car accident attorney even if you think your time to file has passed.

Seemingly minor injuries can become severe over time. That’s why it’s important that all individuals involved in car accidents be seen by a doctor as soon as possible.

Insurance companies are going to want to protect their bottom lines, so they may offer a very low settlement to meet that goal. Ask insurers to speak only with their attorney to ensure you don’t end up with a payout that doesn’t cover your damages.

It is possible to handle a car accident case on your own. However, you may be short-changing yourself in doing so. Having experienced representation is the best way to get the compensation you deserve to get back on your feet. In addition, having an attorney on your side means you can focus on recovering from any injuries you may have incurred.

Car accident settlements vary depending on a variety of factors. Those include the seriousness of the injuries sustained, how many people were involved, and more. Rather than simply accepting an insurer’s settlement, it’s often a good idea to get help from an attorney who can determine what the ideal compensation would be given all the factors involved.

Most personal injury cases get settled out of court. But, there are situations in which going to trial could be necessary. Having a reliable and caring expert on your side means you’ll have an advocate who understands the process and is looking out for your best interests.

Yes. Most states are either considered “fault” or “no-fault” regarding their car insurance rules, and Texas falls into the former category. In a fault state like Texas, you may generally pursue a compensation claim directly against the at-fault driver or their insurer after a car accident. In no-fault states, you may only file a claim against your own insurance company in most cases.